Why did this happen?

In its simplest form, banks gather deposits from clients (individuals and corporations), and they pay those clients a short-term interest rate. They then invest some of those deposits in fixed income securities, like US Treasuries or mortgage-backed securities. Depending on the duration of their fixed income portfolios, like many investors’ fixed income portfolios, some banks experienced substantial market declines during 2022. With a smaller fixed income portfolio, they have less money to repay their depositors, should they want to withdraw their money. If one depositor wants to withdraw their money, it’s not really a problem. But if enough depositors want to withdraw their money, you have a bank run. In the case of SVB, run risk was higher given the depositor concentration with Venture Capital–backed companies. The intersection of these risk can result in liquidity risk, which is at the core of the issue today.

How did the government act?

The government acted quickly to bolster confidence in the banking system. Key actions over the weekend included:

Protecting depositors – The Treasury pledged to fully protect all Silicon Valley Bank (SVB) and Signature Bank deposits. This will help minimize the impact on SVB’s technology-heavy client base, and it also should help reassure depositors of other banks as well.

Ensuring bank liquidity – Reminiscent of the alphabet soup of acts we saw during the global financial crisis (GFC), the Fed is creating a program to support other banks in a similar situation to SVB. The “Bank Term Funding Program” (BTFP) will offer loans to banks and treat all collateral at 100% of its face value. For example, if a Treasury bond was purchased for $100 and has declined in price to $90, the Fund will treat the bond’s value at $100 for collateral purposes. This temporarily eliminates the fixed income portfolio loss issue discussed earlier. The loans are good for one year, allowing banks to raise additional capital or seek financial partners. Importantly, the Fund is designed to be large enough to protect all uninsured deposits in the wider US banking system.

These actions focus on protecting depositors and the confidence of the banking system; these programs do not protect shareholders or debt holders.

What should I do?

This is not the global financial crisis. Banks are better capitalized, the government has learned a lot of hard lessons on how to handle bank failures, and the root causes of today’s issues are very different. All that being said, we expect some additional fallout from this episode, and we expect some continued market volatility as the ramifications of last week’s events are fully understood.

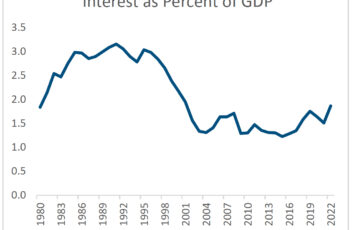

On the bright side, the Fed can now understand that its rate-hiking cycle has destabilized the financial system. Promoting financial stability is one of the Fed’s core functions, in addition to its dual mandate of price stability and full employment. As such, we expect the Fed to be more cautious in future rate hikes, potentially leading to a more stable rate environment.

In every economic cycle and every market cycle, there are risks, and there are opportunities. Last week reminded us that some risks can spiral out of control if they are not contained. Thankfully, quick action from the Fed, Treasury, and FDIC substantially reduced the risk of a financial crisis. But risks remain, and today’s risks are tomorrow’s opportunities. Perhaps that’s the nature of market cycles. Just as we encourage investors to stay invested through recessions and bear markets, we encourage investors to remain disciplined in their long-term investment plans.

Important Information

This is for informational purposes only, is not a solicitation, and should not be considered investment, legal or tax advice. The information in this report has been drawn from sources believed to be reliable, but its accuracy is not guaranteed, and is subject to change. Investors seeking more information should contact their financial advisor. Financial advisors may seek more information by contacting AssetMark at 800-664-5345.

Investing involves risk, including the possible loss of principal. Past performance does not guarantee future results.Asset allocation cannot eliminate the risk of fluctuating prices and uncertain returns. There is no guarantee that a diversified portfolio will outperform a non-diversified portfolio. No investment strategy, such as asset allocation, can guarantee a profit or protect against loss. Actual client results will vary based on investment selection, timing, market conditions, and tax situation. It is not possible to invest directly in an index. Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly. Index performance assumes the reinvestment of dividends.

Investments in equities, bonds, options, and other securities, whether held individually or through mutual funds and exchange traded funds, can decline significantly in response to adverse market conditions, company-specific events, changes in exchange rates, and domestic, international, economic, and political developments.

Bloomberg® and the referenced Bloomberg Index are service marks of Bloomberg Finance L.P. and its affiliates, (collectively, “Bloomberg”) and are used under license. Bloomberg does not approve or endorse this material, nor guarantees the accuracy or completeness of any information herein. Bloomberg and AssetMark, Inc. are separate and unaffiliated companies.

AssetMark, Inc. is an investment adviser registered with the U.S. Securities and Exchange Commission.

©2023AssetMark, Inc. All rights reserved.105476| C23-19748| 03/2023| EXP03/31/2025

AssetMark, Inc.

1655 Grant Street10thFloorConcord, CA 94520-2445800-664-5345